DECEMBER 2023

TOO MANY MANAGERS CHASE YIELD OVER GROWTH

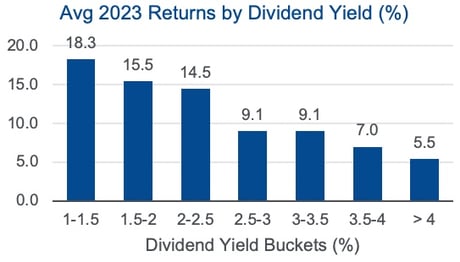

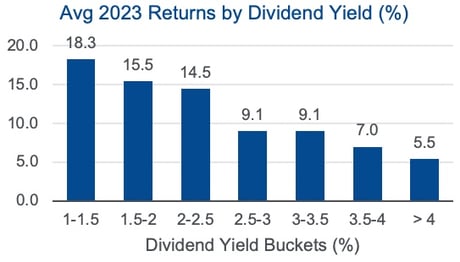

The S&P 500 closed 2023 up 26.3%, but many dividend managers missed the rally. The average U.S. dividend strategy returned 11.5% (net) over the same period, and strategies with 2.5%+ dividend yields (more than half of the universe) were only up 8.4% on average.

The S&P 500 closed 2023 up 26.3%, but many dividend managers missed the rally. The average U.S. dividend strategy returned 11.5% (net) over the same period, and strategies with 2.5%+ dividend yields (more than half of the universe) were only up 8.4% on average.

DIVIDEND MANAGERS DON'T HAVE TO AVOID GROWTH

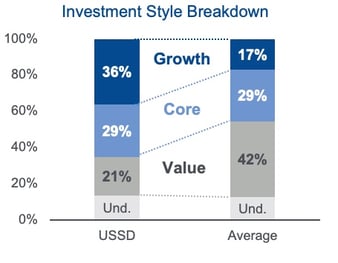

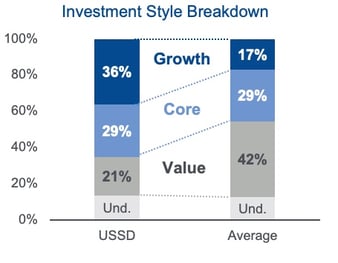

By our work, we estimate the average U.S. dividend manager is overweight Value and underweight Growth styles. In comparing the holdings of a sample of U.S. dividend manager constituents to the Russell 1000 + Value + Growth subsets, we found the average dividend strategy was 42% Value and 17% Growth by weight. In contrast, the U.S. Select Dividend strategy was 21% Value and 36% Growth.

IF YOU ARE STUCK IN A VALUE TRAP, LET'S TALK ABOUT HOW TO GET OUT

The Advisory Research U.S. Select Dividend strategy has a strong performance history and could make for a good replacement to an underperforming, value trap dividend manager.

.jpeg?width=709&height=206&name=Image%202-1-24%20at%208.17%20PM%20(1).jpeg)

ABOUT THE ADVISORY RESEARCH U.S. SELECT DIVIDEND STRATEGY

The U.S. Select Dividend strategy (“USSD”) focuses on high-quality, blue chip companies with deep, defensive moats and sustainable cash flows. USSD targets companies with this profile that are also trading at a discount to intrinsic value. The strategy seeks to offer current income and income growth, as well as capital appreciation potential, with less risk than the broader market.

The strategy strives to outperform the benchmark over a full market cycle by limiting full participation in market downturns. A focus on companies exhibiting capital discipline, as opposed to those with simply high dividend yields, may make USSD an appropriate investment solution regardless of whether dividend investing is in or out of favor.

- Inception Date: 12/31/2010

- Accessibility: SMA

- Minimum Investment: $250,000

- Number of Holdings: 25-35

PDF Version

Advisory Research composite peer rankings represent percentile rankings which are based on the respective monthly returns and reflect where those returns fall within the indicated eVestment Alliance (EA) universe. Ranking data is based on performance as of 12/31/23. The analysis was generated on 1/25/24 and is subject to change as additional firms within the category submit data. EA provides third party databases, including the institutional investment database from which the presented information was extracted. The EA institutional investment database consists of thousands of active institutional managers, investment consultants, plan sponsors, and other similar financial institutions actively reporting on over 10,000 products. Advisory Research pays an annual fee to eVestment to access their platform and to use their data, including peer group rankings, in marketing materials. Advisory Research does not pay for the ranking. Unless otherwise noted, periods over one year are annualized. Historical performance is preliminary and based on the U.S. Select Dividend composite. Actual client portfolio results may differ, based on, among other things, an account’s particulate investment objectives and restrictions, asset levels and timing of contributions and withdrawals. Certain accounts in the composite pay a “wrap fee” based on a percentage of assets under management. As such, gross performance is a pure gross return and includes performance that is gross of trading cost/commissions and management fees. Net performance is shown net of all fees, including the entire actual wrap fee charged. Source: eVestment, INDATA as of 12/31/23. Past performance is no guarantee of future results. An index is unmanaged and unavailable for direct investment.

Historical performance is preliminary and based on the U.S. Select Dividend composite. Actual client portfolio results may differ, based on, among other things, an account’s particulate investment objectives and restrictions, asset levels and timing of contributions and withdrawals. Certain accounts in the composite pay a “wrap fee” based on a percentage of assets under management. As such, gross performance is a pure gross return and includes performance that is gross of trading cost/commissions and management fees. Net performance is shown net of all fees, including the entire actual wrap fee charged.

Past performance does not guarantee future results. Investing in securities involves risk, including the possibility of the loss of principal.

Certain information contained herein constitutes forward looking statements, projections and statements of opinion (including statements of financial market trends). Such information can typically be identified by the use of terminology such as “may”, “will”, “should”, “expect”, “anticipate”, “project”, “estimate”, “intend”, “continue” or “believe” or comparable terminology. All projections, opinions and forward looking statements are based on information available to Advisory Research as of the date of this presentation, and Advisory Research’s current views and opinions, all of which are subject to change without notice. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in forward looking statements. Additionally, information and views presented herein may be drawn from third-party or public sources which are believed, but not guaranteed, to be reliable and which have not been verified for accuracy or completeness.

Advisory Research is providing this material for informational purposes only. The information provided is not intended to recommend any company or investment described herein, and is not an offer or sale of any security or investment product or investment advice. Before making any investment decision, you should seek expert, professional advice and obtain information regarding the legal, fiscal, regulatory and foreign currency requirements for any investment according to the laws of your home country or place of residence.

Advisory Research’s strategies are actively managed and not intended to replicate the performance of any cited index: the performance and volatility of Advisory Research’s investment strategies may differ materially from the performance and volatility of a cited index, and their holdings will differ significantly from the securities that comprise the index. You cannot invest directly in an index, which does not take into account trading commissions and costs.

Advisory Research is an investment adviser in Chicago, IL. Advisory Research is registered with the Securities and Exchange Commission (SEC). Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. Advisory Research only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of Advisory Research’s current written disclosure brochure filed with the SEC which discusses among other things, Advisory Research’s business practices, services and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov

The S&P 500 closed 2023 up 26.3%, but many dividend managers missed the rally. The average U.S. dividend strategy returned 11.5% (net) over the same period, and strategies with 2.5%+ dividend yields (more than half of the universe) were only up 8.4% on average.

The S&P 500 closed 2023 up 26.3%, but many dividend managers missed the rally. The average U.S. dividend strategy returned 11.5% (net) over the same period, and strategies with 2.5%+ dividend yields (more than half of the universe) were only up 8.4% on average.

.jpeg?width=709&height=206&name=Image%202-1-24%20at%208.17%20PM%20(1).jpeg)

.jpg?width=1000&height=1000&name=Swaim%20(website).jpg)

.jpg?width=1000&height=1000&name=Harvey%20(website).jpg)

.jpg?width=1000&height=1000&name=Steffanus%20(Website).jpg)

.jpg?width=1000&height=1000&name=M.%20Valentinas%20(website).jpg)

-min.jpg?width=394&height=394&name=Zessar%20(website)-min.jpg)

-1.jpeg?width=502&height=502&name=Florida%20(website)-1.jpeg)

.jpg?width=1000&height=1000&name=Lamb%20(website).jpg)

.jpg?width=1000&height=1000&name=Prassas%20(website).jpg)

.jpg?width=1000&height=1000&name=Crawshaw%20(website).jpg)

.jpg?width=1000&height=1000&name=Clarke%20(website).jpg)

.jpg?width=1000&height=1000&name=Cialdella%20(website).jpg)

.jpg?width=1000&height=1000&name=Harmon%20(website).jpg)

.jpg?width=1000&height=1000&name=Tracy%20(Website).jpg)